Roughly 1 / 4 of Tesla’s earnings final quarter have been as a result of recognizing a $600 million achieve on Bitcoin. Tesla nonetheless got here in need of expectations.

Tesla and Bitcoin

Tesla is among the many few massive public corporations that invested a few of their money into cryptocurrency.

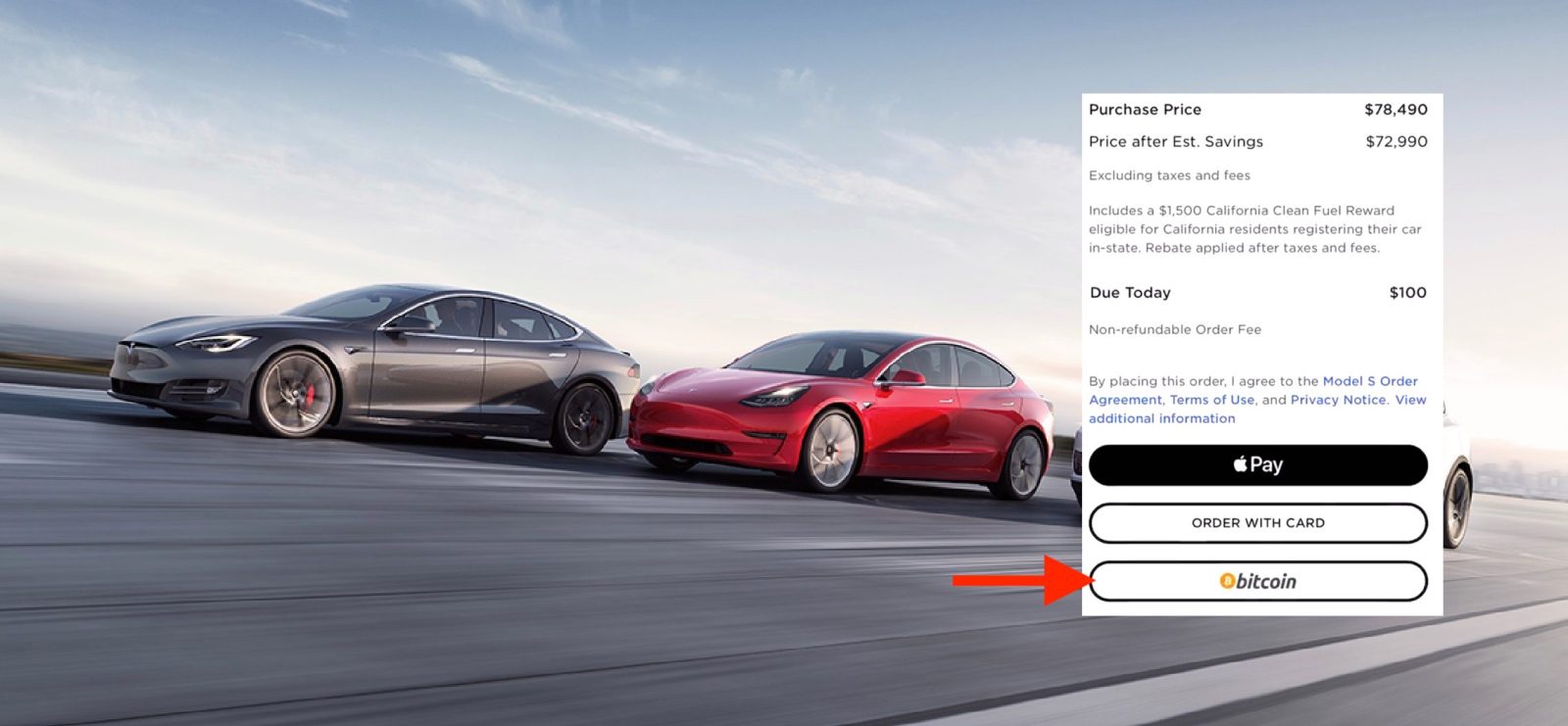

Early in 2021, Tesla invested $1.5 billion in Bitcoin. Shortly after, the automaker began accepting the cryptocurrency as cost on new autos.

Nevertheless, just a few days later, Tesla took a step again with crypto by eradicating the Bitcoin cost possibility. The corporate famous issues over the power wants of the Bitcoin community:

Tesla has suspended car purchases utilizing Bitcoin. We’re involved about quickly rising use of fossil fuels for Bitcoin mining and transactions, particularly coal, which has the worst emissions of any gas.

This can be a concern that many Tesla neighborhood members shared when Tesla first introduced its Bitcoin funding, and plenty of have been angered by the truth that the corporate didn’t give it some thought within the first place.

On the time, Tesla famous that they weren’t promoting their stake in Bitcoin and that they deliberate to renew taking Bitcoin funds as soon as the community confirmed the next mixture of renewable power.

Final yr, Tesla made some strikes that pointed to beginning to take Bitcoin funds once more, but it surely has but to occur.

A yr after the preliminary funding, Tesla’s Bitcoin holding elevated to $2 billion, however the cryptocurrency misplaced a variety of its worth in 2022 and the automaker’s place suffered – although the automaker additionally divested about 75% of its Bitcoin place throughout that point.

Tesla reported over $1.2 billion in proceeds from promoting Bitcoins, however the automaker nonetheless sits on an excellent quantity.

Tesla’s Bitcoin transfer in This fall 2024

Final quarter, Tesla moved its bitcoins round into new wallets, triggering a variety of speculation. We suspected that Tesla may be transferring issues round to adjust to the newest crypto accounting rules.

Certain sufficient, with the discharge of Tesla’s This fall 2024 earnings yesterday, the automaker confirmed that it moved the Bitcoin to adjust to the adoption of ASU 2023-08.

The transfer enabled Tesla to file a $600 million mark-to-market achieve, accounting for a big a part of its $2.3 billion web revenue in This fall, which was already down 70% year-over-year.

Tesla disclosed in a SEC submitting in the present day:

Different revenue (expense), web, modified favorably by $523 million within the yr ended December 31, 2024 as in comparison with the yr ended December 31, 2023 primarily as a result of remeasurement of our bitcoin digital belongings to truthful worth in 2024 (see above), partially offset by unfavorable fluctuations in overseas foreign money change charges on our intercompany balances.

If it wasn’t for Bitcoin, Tesla’s web revenue can be down 78% in This fall 2024 in comparison with This fall 2023.

For those who take away regulatory credit score, it will be down 86% and Tesla’s earnings would add as much as barely greater than $1 billion in comparison with its greater than $1 trillion valuation.

Electrek’s Take

Bitcoin actually saved Tesla’s quarter. Until there’s one other main run-up in Bitcoin, that gained’t occur once more as a result of Tesla has benefited from not measuring Bitcoin’s worth for greater than a yr.

It was nice timing for Tesla, but it surely gained’t be capable of save the corporate in Q1 2025, which is predicted to be tougher because it transitions its Mannequin Y to the brand new model.

However based mostly on the inventory value in the present day, it seems that Elon nonetheless has sturdy shareholders assist as they nonetheless consider in his AI-related predictions.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.