It’s EV earnings season once more, and Rivian (RIVN) is ready to launch important Q2 2024 earnings on Tuesday, August 6, 2024, after the bell. Rivian has been aggressively chopping prices in an effort to realize a gross revenue by the tip of the 12 months. Right here’s what to anticipate from its second quarter report.

Rivian delivered 13,790 autos within the second quarter, up barely from the primary three months of the 12 months (13,588).

Manufacturing at its Regular, IL plant fell from over 17,500 in This fall 2023 to 13,980 in Q1 2024. The development continued with solely 9,612 autos constructed within the second quarter.

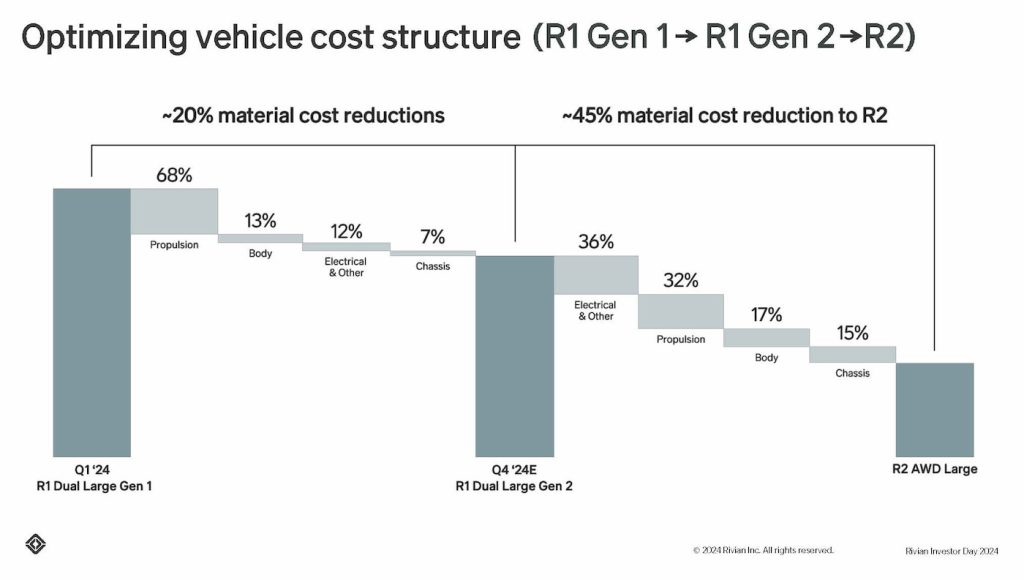

The slowdown was anticipated after a deliberate shutdown in April slowed Rivian’s momentum. CEO RJ Scaringe has mentioned a number of instances that the upgrades have made “significant” impacts on prices and effectivity.

For instance, 100 steps from the battery-making course of, over 50 elements from the physique store, and 500 elements from the design have been eradicated.

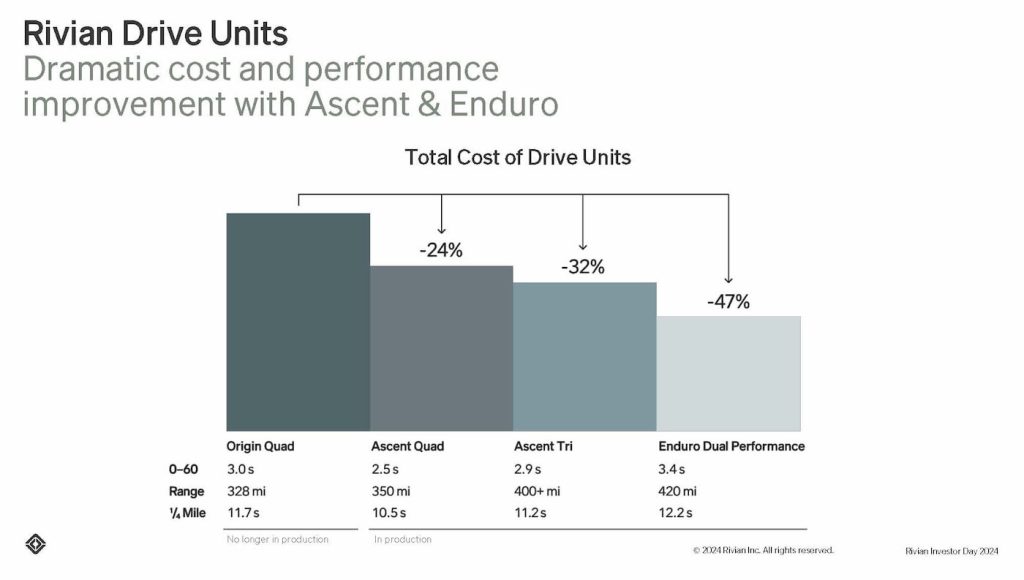

Rivian has additionally considerably diminished the price of its drive models. Its newest in-house Enduro Twin Efficiency models price 47% lower than the Origin Quad motor.

As new tech, like its Maximus motor or “Enduro Gen 2,” is launched, Rivian expects to chop much more prices. The brand new motor might be used on its next-gen R2 and R3 autos.

Rivian to report important Q2 2024 earnings

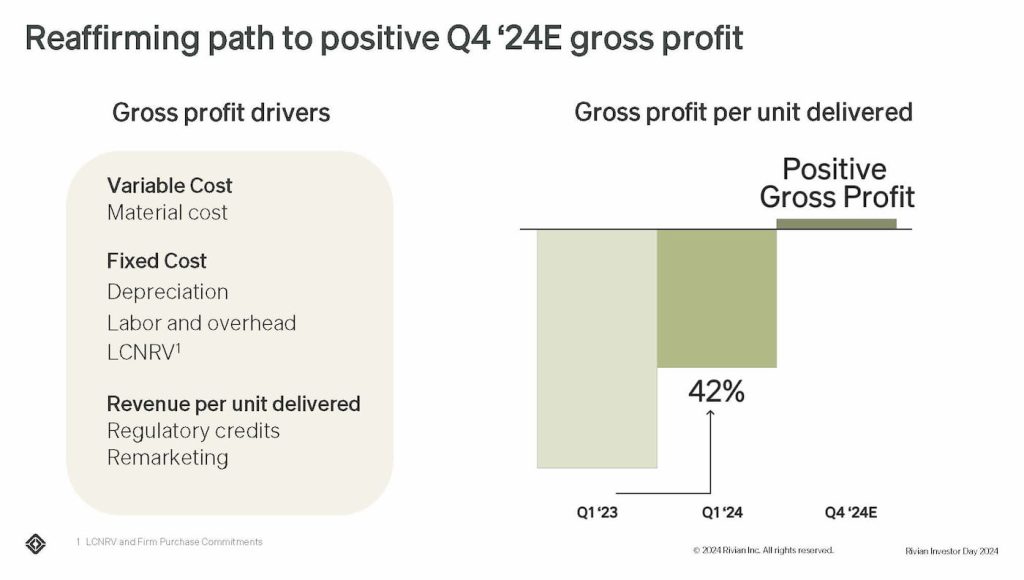

Nonetheless, Rivian’s R2 isn’t due out till early 2026. Though it misplaced $1.4 billion within the first quarter, Rivian expects to realize its first optimistic gross revenue by the tip of the 12 months.

Rivian will launch its Q2 2024 earnings report on August 6, 2024. After aggressively chopping prices, a lot of the progress is not going to be mirrored till the third quarter, in accordance with Scaringe.

| Q3 ’22 | This fall ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This fall ’23 | Q1 ’24 | |

| Rivian loss per car | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 |

Scaringe has already warned of a “messy” second quarter for buyers with the plant shutdown and different investments.

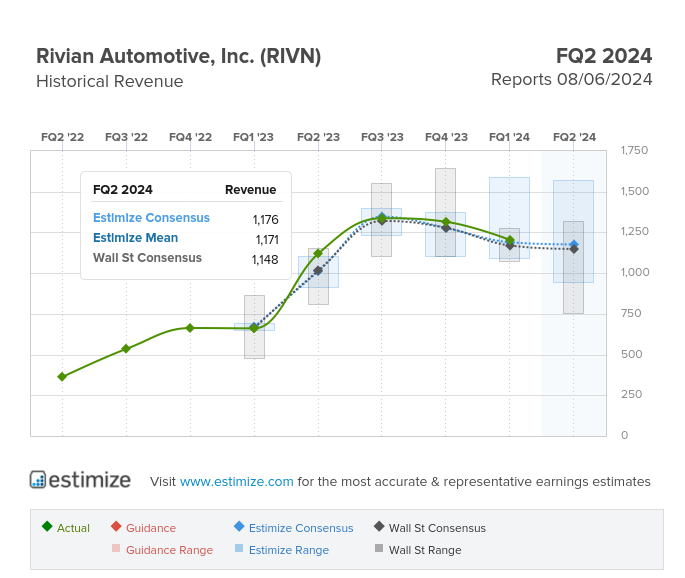

In response to Estimize, Rivian is predicted to report a lack of $1.17 per share on income of $1.18 billion in Q2 2024. Wall St expects a lack of $1.24 per share with $1.15 billion in income.

Regardless of this, Rivian stays on the trail to profitability, executives proceed reiterating. Rivian introduced a huge cope with Volkswagen to develop a next-gen EV structure utilizing its software program experience.

VW will make investments as much as $5 billion, $3 billion of which can go to Rivian. The opposite $2 billion will go towards the three way partnership. The investments are based mostly on hitting sure milestones.

The deal earned Rivian inventory a number of Wall St upgrades. Guggenheim analyst Ronald Jewsikow mentioned, “We see a reputable path to breakeven gross margins” within the fourth quarter.

Jewsikow sees Rivian’s current plant upgrades and provider negotiations as key to reaching optimistic gross revenue. In the meantime, Q2 will probably be one other velocity bump as Rivian plows forward on the trail to profitability.

Rivian’s inventory is up 42% over the previous three months, however share costs are nonetheless down 40% over the previous 12 months.

Verify again tomorrow, Tuesday, August 6, 2024, for a deeper look into Rivian’s financials following its Q2 earnings launch and investor name.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.