Rising demand for nickel, lithium, and phosphates mixed with the pure advantages of electrification are driving the adoption of electrical mining machines. On the identical time, a persistent operator scarcity is boosting demand for autonomous machines.

The mixed components listed above are quickly accelerating the speed at which machines which can be already in service have gotten out of date – and, whereas some firms are exploring the price/good thing about changing current autos to electrical or, in some instances, hydrogen, the final consensus appears to be that extra firms shall be be shopping for extra new tools extra typically within the years forward.

Allied Market Analysis, as an example, is forecasting the world mining tools market will develop from $141B in 2023, reaching a complete worth of greater than $200B in 2040 based mostly on a compound annual progress charge (CAGR) of 4.1% … however that appears hopelessly gradual.

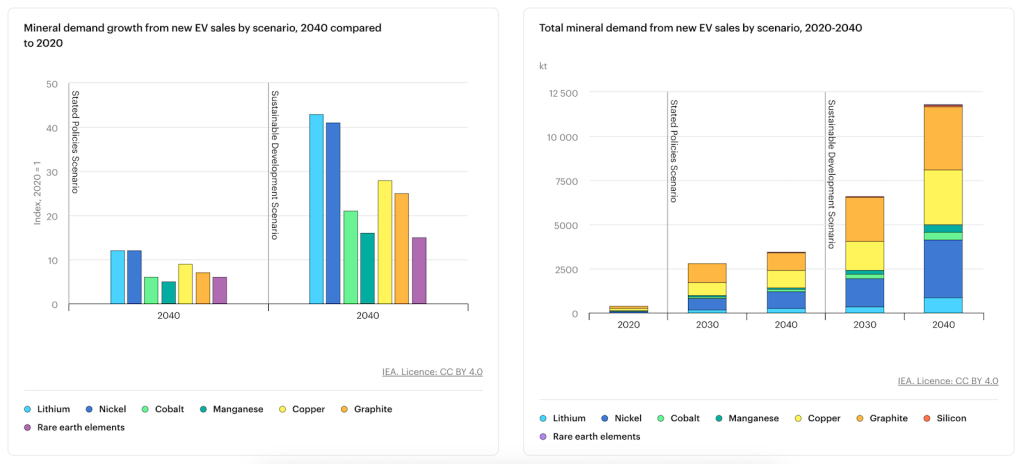

The Worldwide Power Company (IEA, a Paris-based, 31 nation group established in 1974 that gives coverage suggestions, evaluation and knowledge on the worldwide vitality sector) initiatives that mineral demand from EVs will see 30x progress between 2020 and 2040, with demand for lithium and nickel rising 40x as demand for diesel is dropping quicker than most individuals predicted, reaching a 26-year low final quarter.

Mineral demand projections

The IEA’s projections take a number of battery growth eventualities into consideration, and embody more and more acquainted phrases like utility-scale battery vitality storage. All of which is to say: they appear like completely conceived and well-executed projections, with nothing clearly squirrely occurring within the scaling or something like that (#pythonistas).

A delayed shift to nickel-rich chemistries (and away from cobalt-rich chemistries) ends in practically 50% larger demand for cobalt and manganese in 2040 in comparison with the bottom case. Nickel demand is 5% decrease in 2040 in comparison with the bottom case.

The quicker uptake of lithium metallic anodes and ASSB ends in 22% larger lithium demand in 2040 in comparison with the bottom case, but additionally a lot decrease demand for graphite (down 44%) and silicon (down 33%).

Shifting quickly in direction of a silicon-rich anode ends in practically thrice as a lot silicon demand in 2030 in comparison with the bottom case, and a slight lower in graphite demand (down 6%). By 2040 silicon demand is simply 70% larger, owing to a better adoption of silicon-rich anodes even within the base case.

So, there’s extra demand for stuff that’s mined. Which means there shall be extra mines, and extra mining, however not essentially extra individuals keen to go down into these mines. That labor scarcity, coupled with stricter security rules and the rising risk of high-dollar lawsuits ensuing from office accidents, virtually invitations extra automation into the area.

The distant areas of mines and the repetitive nature of the work additionally invitations automation. “A mining automobile sometimes travels the identical route or makes the identical actions over the course of the day, similar to digging and loading materials right into a automobile,” writes Sara Jensen, at Energy & Movement. “This aids the design of an autonomous system as a result of there are identified patterns which may be extra simply built-in in comparison with the numerous drive cycles of on-road autos.”

Massive gamers spending huge cash

It ought to come as no shock, then, that the race is on to carry sensible, electrical, and autonomous heavy mining tools to market. At CES this previous 12 months, autonomous electrical tools from Hyundai, Bobcat, Volvo CE, and Caterpillar garnered plenty of consideration with their progressive ideas (above) – and for good cause.

IDTechEx estimates a single 150-ton haul truck can use over $850,000 value of gas in a single 12 months. In the meantime, huge electrical haul vehicles like this 240 ton unit from Caterpillar can, in sure use instances with excessive quantities of regenerative braking, function with none vital price to recharge. At that time, the lowered upkeep and downtime of BEVs in comparison with diesel autos turns into icing on the TCO cake.

All of which makes that 4.1% progress quantity from Allied appear conservative, at greatest.

SOURCES: Allied Market Analysis, IEA, Energy Movement; different sources linked in submit.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.