Lucid Motors (LCID) topped Wall Road’s Q2 income estimates Monday after asserting one other $1.5 billion funding from Saudi Arabia’s Public Funding Fund (PIF).

Lucid experiences Q2 2024 earnings outcomes

Lucid delivered a document 2,394 automobiles within the second quarter, up 22% from the earlier document in Q1 2024 (1,967).

Manufacturing at its AMP-1 manufacturing plant additionally picked up, with 2,110 fashions in-built Q2. Though it must construct one other 5,163 EVs in 2024 to fulfill its goal, Lucid stated it stays on observe to supply 9,000 EVs this 12 months.

With output and deliveries selecting again up, Lucid reported Q2 income of $200.6 billion, topping Wall St estimates of round $192 billion.

Regardless of this, Lucid missed Wall St EPS estimates reporting a lack of 29 cents per share in Q2 vs 26 cents per share anticipated.

- Lucid Q2 2024 Income: $200.6 billion vs $192 billion anticipated.

- Lucid Q2 2024 EPS: (-$0.29) vs (-$0.26) anticipated.

Lucid ended the quarter with $4.28 billion in liquidity. With one other $1.5 billion dedication from Ayar Third Funding Co, an affiliate of Saudi’s PIF, Lucid stated it has sufficient liquidity runway till at the least This fall 2025.

CEO Peter Rawlinson stated he’s “very inspired” by the momentum Lucid is constructing. Lucid is gearing as much as launch its first electrical SUV, the Gravity, later this 12 months.

New EV fashions and tech launches are coming quickly

Lucid plans to begin Gravity manufacturing in late 2024. It is going to be accessible beginning at underneath $80,000 as Lucid expands its market.

The first Gravity electrical SUV prototype rolled off the meeting line at its Casa Grande manufacturing facility final month. Rawlinson shared a video, saying the “Gravity SUV represents a major leap ahead for Lucid’s world main tech and design.”

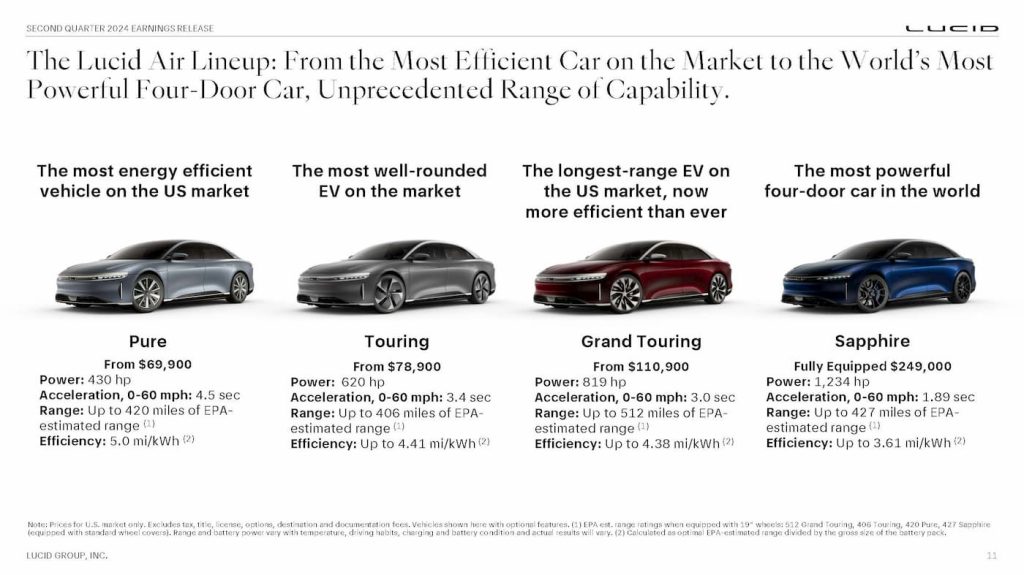

Lucid confirmed final month that the 2025 Air Pure is the “most energy-efficient mass manufacturing automobile ever,” with 5 miles per kWh and a document 146 MPGe EPA estimated vary score.

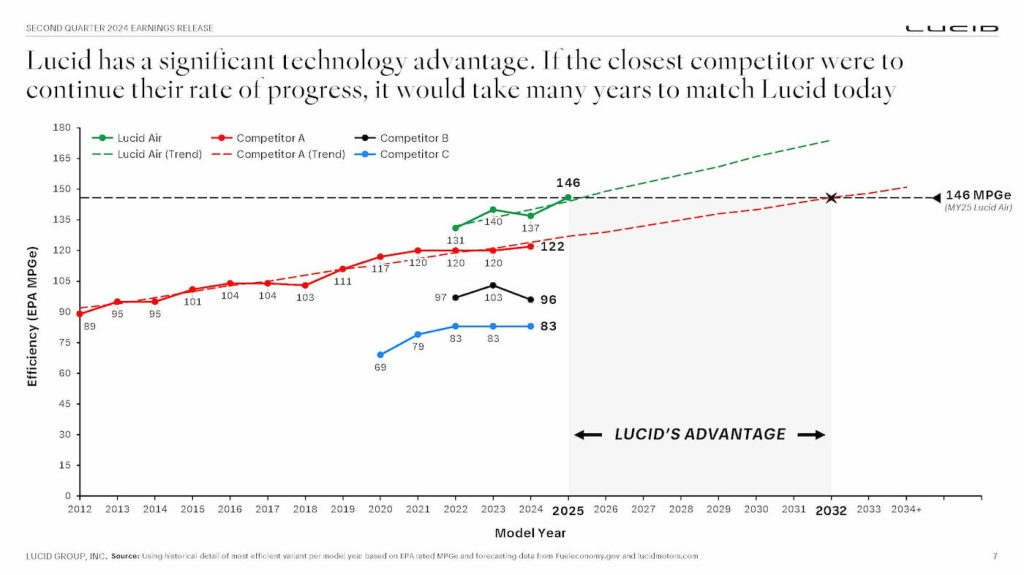

The EV maker claims its superior tech provides it a major benefit. Lucid stated it might take the closest competitor years to match Lucid’s present price of progress.

With ultra-efficient automobiles, Lucid stated it’s decreasing the price of making an EV vs the competitors. The Lucid Air Pure begins at $69,900, down from round $90,000 when it launched.

Lucid is seeing continued curiosity in its tech, the EV maker revealed Monday. With a lower-priced midsize SUV slated to enter manufacturing in late 2026, Lucid (like Rivian) goals to develop the model into the mass market.

Lucid’s inventory is up practically 10% in Monday’s after hours buying and selling following the discharge. Nevertheless, Lucid shares are nonetheless down 50% over the previous 12 months slipping beneath $5 per share.

Examine again for more information after Lucid’s Q2 earnings name with buyers at 5:30 pm EST.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.