EV maker Rivian (RIVN) launched its third-quarter monetary earnings Thursday after the market closed. With fewer deliveries within the quarter, Rivian’s income missed expectations. Nonetheless, the EV maker guarantees issues are trying up from right here. Right here’s a breakdown of Rivian’s Q3 2024 monetary earnings

Earnings preview

Yesterday, Electrek posted a preview of what to look out for in Rivian’s third-quarter earnings. One of many largest issues buyers might be watching is Rivian’s high line.

After a provide scarcity triggered Rivian to decrease its manufacturing aim for 2024, the corporate now expects to construct between 47,000 and 49,000 autos this 12 months, down from the earlier 57,000 goal.

With one other 13,157 EVs constructed final quarter, Rivian’s manufacturing whole reached 36,749 via September. To hit its goal, Rivian might want to construct one other 10,251 to 12,251 autos in This fall.

Regardless of this, Rivian nonetheless expects slight supply progress over final 12 months, with between 50,500 and 52,000 items delivered in 2024, up from 50,122 in 2023.

In accordance with Estimize, Rivian is predicted to report a lack of $0.96 per share in Q3 2024, an enchancment from the 1.19 loss per share final 12 months. Rivian is predicted to report income of round $1 billion, which might be a 25% drop from the $1.34 billion generated in Q3 2023.

Rivian Q3 2024 earnings breakdown

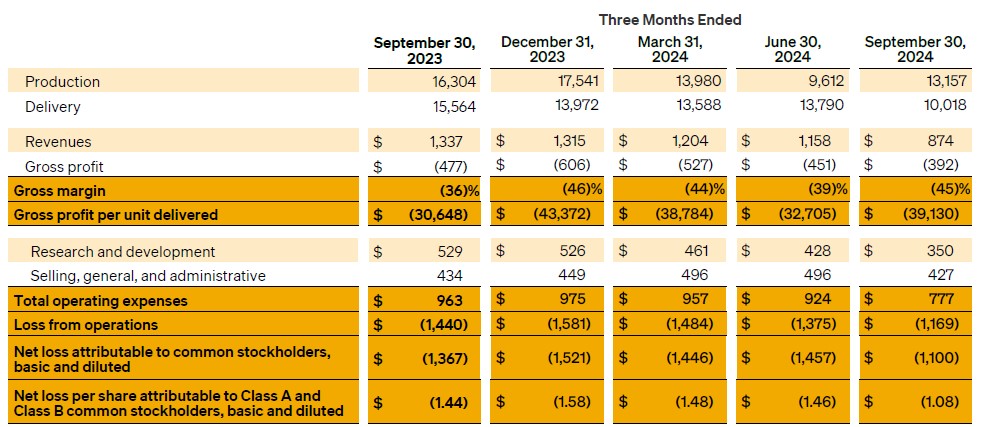

Rivian reported third-quarter income of $874 million, an almost 35% drop from Q3 2023 and lacking expectations.

The corporate mentioned greater electrical supply van (EDV) deliveries for Amazon final 12 months was partly the rationale for the decrease top-line whole.

Rivian posted a gross revenue lack of $392 million, down from the $477 million loss final 12 months because of the decrease supply whole. In the meantime, working losses additionally fell to $1.17 billion, down from $1.44 billion in Q3 2023.

The corporate misplaced $39,130 on each car delivered in Q3 2024, which is up from $30,648 final 12 months and $32,705 in Q2 2024.

| Q3 ’22 | This fall ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This fall ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | |

| Rivian loss per car | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 | $39,130 |

Rivian’s web loss within the third quarter was $1.1 billion, down from $1.34 billion final 12 months with a $1.08 loss per share.

The EV maker confirmed it’s nonetheless on observe for a optimistic gross revenue within the fourth quarter of 2024. Rivian’s CEO, RJ Scaringe, mentioned the corporate is seeing “significant progress” on its materials prices with new tech and manufacturing processes.

| Q1 2024 | Q2 2024 | Q3 2024 | 2024 YTD | 2024 steering | |

| Deliveries | 13,588 | 13,790 | 10,018 | 37,396 | 50,500 – 52,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 36,749 | 47,000 – 49,000 |

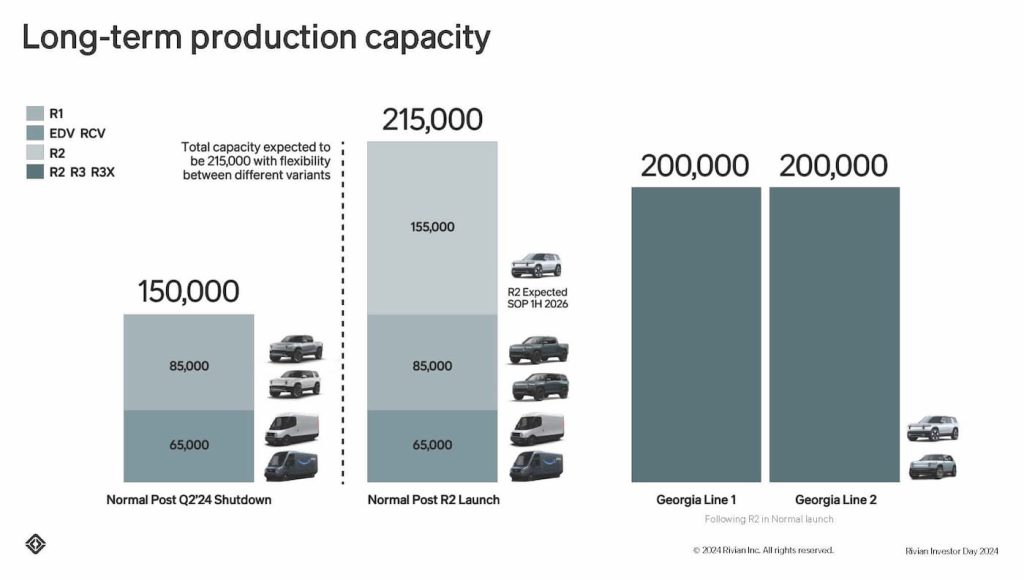

These enhancements are significant steps towards its next-gen R2, which is able to launch within the first half of 2026.

Scaringe mentioned Rivian believes R2 might be a “basic driver of Rivian’s progress.” It should begin at $45,000, practically half the price of its present R1S and R1T fashions.

As soon as R2 manufacturing begins, Rivian expects the brand new EV will account for many of its output. The corporate plans to construct 155,000 R2 fashions yearly and about 85,000 R1S and R1Ts in Regular.

Rivian additionally believes its new alliance with Volkswagen might be “a landmark improvement for the business.” The overall deal measurement is as much as $5 billion, which Rivian mentioned is a “significant monetary alternative.”

The deliberate investments along with Rivian’s present money and equivalents “are anticipated to offer the capital to fund Rivian’s operations via the ramp of R2 in Regular, in addition to the midsize platform in Georgia,” the corporate mentioned. It will set up a path to optimistic free money move and significant scale.

The corporate ended the quarter with $6.7 billion in money and equivalents, together with a $1 billion convertible notice from Volkswagen. Rivian reaffirmed its (revised) manufacturing and supply targets for 2024.

As a result of decrease manufacturing outlook, Rivian now expects an EBITDA lack of $2.83 billion to $2.88 billion, in comparison with the earlier steering of a $2.7 billion loss.

Test again for extra following Rivian’s earnings name with buyers. We’ll put up updates beneath.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.