Rivian (RIVN) launched its second-quarter earnings after the market closed on Tuesday because the EV maker aggressively cuts prices. CEO RJ Scaringe referred to as the quarter a “defining one” as Rivian eyes its first gross revenue by the tip of the yr. Right here’s a breakdown of Rivian’s Q2 2024 earnings.

Rivian second quarter earnings preview

After delivering 13,790 autos in Q2, up barely from the primary three months of 2024, Rivian expects output to ramp up within the second half of the yr.

Attributable to a deliberate shutdown at its Regular, IL manufacturing facility in April, Rivian’s manufacturing slipped from over 17,500 in This autumn 2023 to 13,980 in Q1, with simply 9,612 constructed within the second quarter of 2024.

Rivian has launched drastic price financial savings measures, together with manufacturing upgrades and provider contracts. Over 100 steps from the battery-making course of, 50 parts from the physique store, and 500 components from design have been eradicated.

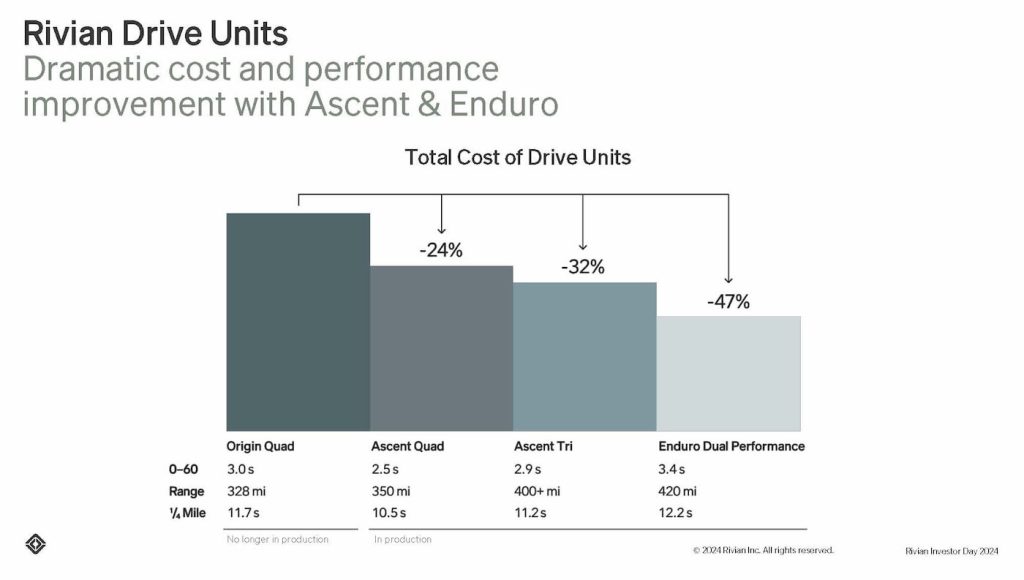

With its new in-house drive items, Rivian cuts 47% of the prices in comparison with its Origin Quad motor. Rivian expects the pattern to proceed as new tech rolls out.

We posted an earnings preview yesterday on what to anticipate from Rivian’s Q2 report. Rivian misplaced one other $1.4 billion in Q1 however expects to attain its first constructive gross revenue by the tip of the yr.

In line with Estimize, Rivian is anticipated to report a lack of $1.17 per share on income of $1.18 billion in Q2. Wall Avenue expects barely much less, with a lack of $1.24 per share on income of $1.15 billion.

Rivian Q2 2024 earnings breakdown

Rivian made “vital progress driving higher price effectivity, bettering its merchandise, additional strengthening its steadiness sheet, validating the differentiated nature of its expertise stack, and establishing new enterprise alternatives” in Q2.

CEO RJ Scaringe stated the second quarter was a “defining one for Rivian.” Rivian reported income of $1.158 billion, assembly Wall St expectations.

Rivian’s gross loss elevated barely year-over-year to $451 million in comparison with $412 million in Q2 2023.

- Rivian Q2 2024 income: $1.158 billion vs $1.15 billion anticipated

- Rivian Q2 2024 EPS: (-$1.13) vs (-$1.15) anticipated

The EV maker stated decrease promoting costs and fewer effectivity as a result of plant shutdown led to greater losses. Because of this, Rivian posted a internet lack of $1.46 billion, about flat from the $1.48 billion Q1 loss.

Rivian misplaced $32,705 on each automobile inbuilt Q2, an enchancment from the $38,784 loss in Q1 however nonetheless greater than the $30,500 loss in Q3 2023.

Rivian ended Q2 with $7.87 billion in money and equivalents. Together with its revolving credit score facility, Rivian had $9.18 billion in liquidity.

The steadiness consists of $1 billion from Volkswagen as a part of its current partnership. Rivian signed a cope with Volkswagen in June to make use of its software program experience to create a next-gen EV structure. Volkswagen will make investments as much as $5 billion, $3 billion of which is able to go to Rivian and $2 billion to the three way partnership. Nonetheless, the investments are based mostly on hitting sure milestones.

| Q3 ’22 | This autumn ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This autumn ’23 | Q1 ’24 | Q2 ’24 | |

| Rivian loss per automobile | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 |

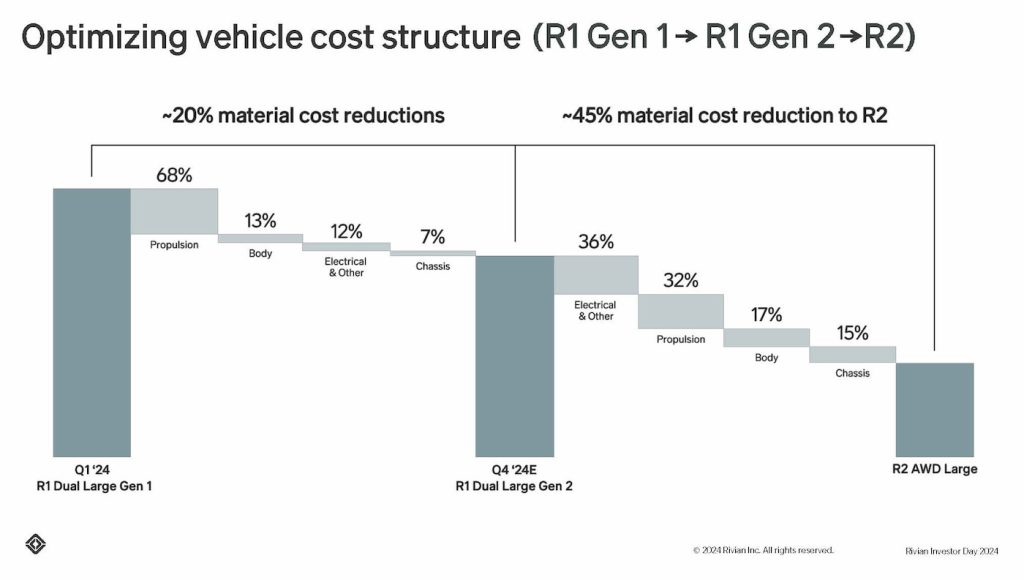

After launching its second-gen R1 fashions earlier this summer season, Rivian expects a 20% materials price discount in comparison with the primary technology.

Following the upgrades, Rivian expects its R1 manufacturing line price to be 30% extra environment friendly, which ought to assist ramp up output into the tip of 2024.

Wanting forward

Rivian is assured it’ll obtain a constructive gross revenue in This autumn 2024. The corporate is beginning to see impacts from upgrades at its Regular, IL plant and expects to see extra ends in the second half of the yr.

The corporate reaffirmed that it’s on observe to construct 57,000 autos this yr and earn $2.7 billion in adjusted EBITDA.

Wanting additional out, Rivian expects the momentum to speed up with the lower-cost R2 launching in early 2026. Beginning at $45,000, Rivian’s R2 is anticipated to open up an enormous market.

In line with Rivian’s Vice President of Manufacturing Tim Fallon, the R2 has “properly over 100,000” pre-orders and continues to climb.

Scaringe not too long ago defined that R2 is “worlds totally different” than the Tesla Mannequin Y, the benchmark within the EV business.

When R2 manufacturing begins in early 2026, Rivian expects plant output to achieve 215,000 items yearly, up from round 150,000. The R2 will account for about 155,000, with the R1S and R1T at about 85,000.

Verify again for more information following Rivian’s earnings name with traders at 5 pm ET. We’ll preserve you up to date on the most recent beneath.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.